P&C Insurer + PilotFish Break Underwriting Barriers with Artificial Intelligence and Machine Learning

Automation and AI are mission-critical in today’s P&C marketplace. Carriers must become even faster, more agile and more innovative. This P&C leader implemented a highly collaborative partnership with PilotFish to develop models using Artificial Intelligence (AI), including Natural Language Processing (NLP) and Machine Learning (ML), to achieve improvements in underwriting and quoted rates. By investing in new technology and leveraging PilotFish’s integration solution suite and professional services, this carrier put three AI models into production in less than a year.

THE CLIENT

The portfolio of this leading P&C insurer addresses both standard and specialized commercial property and casualty insurance across a wide range of industries and customers. Products focus on property and liability coverage for clients requiring underwriting. The CIO mandated the IT teams to embrace automation and AI as mission-critical. One profitable result of the firm’s continued investment in technology is eliminating the more mundane parts of the underwriting process. Underwriters then are freed to do what they do best – focus on clients to produce customized solutions based on the data.

THE CHALLENGE

The CIO defined the challenge of automation and AI as giving clients the best of both worlds – the speed of its platform with the power of its underwriters. Partnership with PilotFish had moved the firm’s digital transformation strategy forward. Modernizing core systems allowed their underwriters to price policies and get them to partners much faster.

As the firm benefited more and more from what PilotFish could do and solve, the CIO was confident the collaboration with PilotFish in innovative initiatives would continue to create a competitive advantage. A collaborative vision between PilotFish and the Client was triggered by a joint intellectual curiosity of how emerging cutting-edge machine learning could be applied to everyday, legacy problems in the insurance industry to create efficiencies.

The collaborative partnership turned to machine-learning innovations to further automate the quoting process and greatly minimize if not eliminate the need for human intervention. The more applications quoted automatically, the faster those applications are back in the hands of the brokers.

The goal was to improve the quoted rate by at least 10% for automated submissions.

THE SOLUTION

The firm’s initial AI model developed by PilotFish was focused on increasing the mapping rate for property class codesClass codes, also called classification codes, help insurers categorize businesses according to factors like liability, risk, and industry type. from the property insurance applications received via an internal system. Underwriting in the Property & Casualty insurance business is driven by documents and therefore unstructured data. Examples of building descriptions that would map to Property Code 0321 are as diverse as ‘Apartments with mercantile up to 10 units’ or ‘2 Story Joisted Masonry Building, 1st fl leased to beauty parlor, 2nd fl is 2 residential units’.

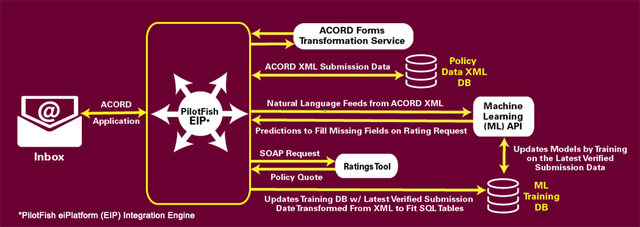

The applications are ACORD-based forms for new business. They arrive as attachments to a standard email. The property class codes are one of the fields used to produce a quote using a separate software system communicated via SOAP requests. Problematically, the property class code is the required field most often missing. The challenges of developing an AI solution were driven by (a) how the underwriters described the property and (b) how the old system handled the unstructured data that ensued.

PilotFish developed a model employing natural language processing (NLP). As NLP models are self-learning, they can understand context and improve iteratively. A threshold was set that gave a high probability of how likely the prediction of the property code was correct.

Supervised learning was used for the property data classification problem. Supervised machine learning models are trained on labeled data that are considered “ground truth” for the model to identify patterns that predict those labels on new data. The Client had a significant history of previously processed and quoted applications that proved to be a productive source of data against which a machine learning model could adequately be trained.

Data Integration of Missing Property Codes Determined by AI & ML Model

(Click image to enlarge)

In short, the intelligent automation tool is based on a database of labeled data points that give the tool context. The model can look at surrounding information to predict the property code from unstructured data no matter where it appeared in the document or the format of the description. PilotFish and the Client delivered a machine learning solution that allowed the accurate prediction of property class codes based on other discrete pieces of information present in the application. Without this singular data point, an application could not be automatically quoted. With it, rating can be fully automated without human intervention.

THE BENEFITS

The PilotFish ML model and NLP tools were applied to property codes thereby successfully creating a truly scalable, intelligent automated process. Armed with ML and statistical concepts used on this dataset, business knowledge was extracted and integrated into core systems.

Success bred success and after the initial application of NLP and ML to property codes, PilotFish developed two more models that were put into production in less than a year. Classical machine learning was used to successfully predict the correct Construction code. Geolocation was also employed to determine the correct PPC code, essentially how close the property is to a fire station.

The new models met the goals of determining these three codes underpinning new applications more accurately and efficiently. Overall, a 12% increase in quoted rates was achieved.

THE FUTURE

This leading P&C insurer had already gained business advantages with the PilotFish Integration Suite of a single, consistent approach to integrations through:

- Easy electronic exchange between internal systems as well as with external data and information services widely used in the insurance industry

- No-problem syntactic interoperability, semantic interoperability, and workflow interoperability

Application of AI technologies including Natural Language Processing and Machine Learning solutions developed by PilotFish allowed the insurer to automate the process of extracting crucial underwriting data from virtually any kind of document and description.

Measurable financial benefits accrued from improving the quote system with just the three new AI models. The result was more quickly realized profitable new business.

The CIO is confident that by collaborating with PilotFish they can push through barriers to further streamline and improve the business underwriting process and create new business value. The AI vision inspiring the adoption of Machine Learning by the CIO and the PilotFish team gained the enthusiastic mission-critical support of the firm’s entire executive team.

Since its founding in 2001, PilotFish has been solely focused on the development of software products that enable the integration of systems, applications, equipment and devices. Billions of bits of data transverse through PilotFish software connecting virtually every kind of entity in healthcare, 90% of the top insurers, financial service companies, a wide range of manufacturers, as well as governments and their agencies. PilotFish distributes Product Licenses and delivers services directly to end users, solution providers and Value-Added Resellers across multiple industries to address a broad spectrum of integration requirements.

PilotFish will reduce your upfront investment, deliver more value and generate a higher ROI. Give us a call at 860 632 9900 or click the button.