Insurer Leverages PilotFish to Integrate Reflexive Decision-Making Engine with Legacy Systems

Today the insurance industry is challenged to adapt consumer interfaces and internal processes to rapidly changing purchasing preferences. Automated underwriting solutions are essential to real-time online decision making. Learn how this insurer leveraged PilotFish’s Integration Engine to rapidly integrate its web-based real-time reflexive decision-making engine and downstream legacy systems. Aggressive deadlines were met and stretch goals exceeded.

THE CLIENT

The client is a large insurer that offers term life policies to consumers. The company services more than a million term life insurance holders. The client has a sterling reputation for outstanding customer service while delivering highly rated and profitable products. The client’s action-based IT organization agilely meets the client’s growth strategies, bringing in innovation partners and leading technologies. From quotes to claims, the client has mandated making it easier for today’s tech-savvy consumers to do business with them.

THE CHALLENGE

The client needed to replace its public web-facing term life insurance application process with a modern web-based real-time decision-making engine. The process required automated underwriting and streamlining to approval. Consumers were to complete a reflexive online conversational application. They would receive a decision within 10 minutes.

A leading reflexive knowledge-based rules engine vendor was brought in to speed up the interface project. With the reflexive engine, configurable underwriting guidelines and rules react to the consumer’s application input. The reflexive application component responds to context and determines the next questions or steps.

Automated underwriting underpins insurers’ risk assessment decisions at the point of sale. A series of automated underwriting decisions are based on client-defined criteria. Each online term life application ends with a risk-adequate decision.

To make this entire accelerated process succeed, downstream legacy back-end systems needed to be responsive – “rip and replace” was not on the table.

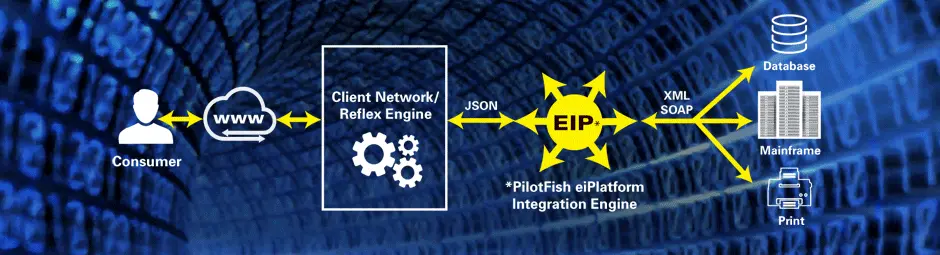

PilotFish’s Integration Engine was selected to beat tight timelines, efficiently integrating the huge volume of new web-based reflexive application data and core downstream legacy systems.

THE SOLUTION

PilotFish’s Integration Engine operated as the backend workflow director for the online web-based term life insurance applications. PilotFish interfaces were utilized to create, coordinate and integrate all downstream workflows – including underwriting, document printing and payment processing.

The client’s fast-paced IT shop emphasizes “getting it done.” A PilotFish Lead Software Engineer was embedded at the client site to drive this critical path strategy. IT realized the legacy systems integration challenge was in no way trivial. The multiple systems involved were complex, customized over the years and intertwined. Documentation was lacking.

Since its inception, PilotFish has been purely focused on integration. PilotFish delivers the expertise and experience to avoid integration pitfalls and quickly solve every integration challenge.

Here, PilotFish’s Integration Engine was utilized to map huge JSON payloads (including third-party vendor attachments) into these legacy system formats.

With PilotFish’s exclusive graphical interface assembly line process, data is parsed and mapped simply and quickly – regardless of format and source. With PilotFish, any integration (no matter how complex) is handled with the same methodology and tools – each and every time.

PilotFish’s Interface Engine delivered impressive built-in capabilities for incoming data translation, outgoing transaction construction, acknowledgment generation, process orchestration and scheduling. With PilotFish, the ongoing stages of the project were completed on time and within budget, exceeding business leaders’ stretch goals.

PilotFish took the complexity out of the middle integration layer critical to automation while leaving the core downstream systems untouched.

THE BENEFITS

PilotFish’s Integration Engine provided all the necessary components, out-of-the-box, to meet the demanding integration requirements of the client’s software delivery process. PilotFish easily integrates anything to anything, anywhere, cloud to ground.

PilotFish met the challenges of integrating the new web-based reflexive term life application process with the necessary downstream legacy software. This included six downstream systems – i.e., the mainframe underwriting system, document production and printing, payment processing, and repositories for consumer application data, checks of identity, Rx history, etc. For PilotFish, the customer data volume and number of data formats, databases and systems were no problem!

Furthermore, PilotFish engaged with the customer with a hands-on, embedded approach and delivered systematic interface iterations that sped up customer’s software delivery process.

PilotFish contributed extra value and benefit to the project’s success as well.

PilotFish innovated a transparency layer as an audit trail. It identified what, where and when anything went wrong in the six systems. IT users gained insight to address issues while looking at the JSON and XML. The business started using the capability too – an unexpected real value-add. Talking the same language meant faster progress.

In this trusted relationship, PilotFish could analyze business requirements and facilitate discussions with businesspeople and IT. The relationship allowed for quickly finding appropriate procedural or technical solutions. We were responsive on-the-spot to last-minute requests as well – such as for encryption. PilotFish was there for every Go Live, thus ensuring success.

PilotFish works with our clients in a way that works best for their objectives. PilotFish is typically do-it-yourself. Clients use online training and documentation independently. As PilotFish’s Integration Engine is configuration driven, no scripting or coding are required. If a little or special support is desired, we do that as well. If it makes sense (as in this case), a PilotFish advisor can be on hand day-to-day leading and implementing the integrations.

PilotFish’s sophisticated architecture was built to meet and simplify the challenges of complex integrations involving new and legacy systems. With PilotFish’s Integration Engine, internal legacy systems do not have to be a barrier to product launches and going live with innovations.

To their tremendous advantage, with PilotFish, companies can focus on modernizing a single component of their suite of both internal and external applications and systems. Engaging PilotFish eliminates the “all or nothing” choice to rewrite downstream legacy systems. Plus, future integrations are “cookie-cutter-easy” – as legacy systems in the stack do get rewritten or replaced.

PilotFish’s Integration Engine is a force-multiplier that ensures faster, better, successful complex integrations of technologies empowering the digital wave sweeping the insurance industry.

Since its founding in 2001, PilotFish has been solely focused on the development of software products that enable the integration of systems, applications, equipment and devices. Billions of bits of data transverse through PilotFish software connecting virtually every kind of entity in healthcare, 90% of the top insurers, financial service companies, a wide range of manufacturers, as well as governments and their agencies. PilotFish distributes Product Licenses and delivers services directly to end users, solution providers and Value-Added Resellers across multiple industries to address a broad spectrum of integration requirements.

PilotFish will reduce your upfront investment, deliver more value and generate a higher ROI. Give us a call at 860 632 9900 or click the button.