Insurer Core Systems Modernization Brings in PilotFish as Transformation Partner

Core systems modernization is a challenge for many insurers yet is necessary for organic growth in mature markets. Greater profitability and speed to market in new product development depend on core technologies to handle big data, analytics, AI and new sales platforms, etc. Unfortunately, promising technology transformations can easily stall out. Initiatives can end up too broad and disjointed or too limited and timid. Discover how this insurer’s partnership with PilotFish evolved the road map and enterprise solution for long-term success. Learn why PilotFish’s Integration Solution delivered meaningful impact in the near term with project after project – in this case, Guaranteed Issue Whole Life.

THE CLIENT

The client is a large insurer whose portfolio includes life insurance, accident and annuity products. The company offers a variety of life insurance solutions – including Term, Whole, and Universal Life Insurance. It supports applications to its highly rated and profitable products by mail, phone, online or with the help of agents. The company is on a technology journey to modernize its core life insurance systems. The initiative is led by its agile technology group. The insurer is partnering with technology innovators and leaders to accomplish its stretch goals and deliver implementations on highly accelerated schedules. The technology group has a decided preference for prototyping and rapid development strategies. Their mandate is to achieve impactful process improvement and business model changes without long development cycles.

THE CHALLENGE

The client is transforming and automating its life insurance technology systems in a phased program on multiple simultaneous fronts. The priorities are to boost operational efficiencies and scale up productivity improvements. The goal is to enable greater investment in new products, systems and capabilities. Simply stated, every process simplification and automation initiative had to deliver more “bang for the buck”.

The company’s Guaranteed Issue Whole Life underwriting system was identified as a priority for modernization with high payback in a short timeframe. The legacy outsourced underwriting system was impeding speed and efficiencies. The company was implementing new underwriting administration and distribution management systems. Both the old and the new vendors’ products and technologies were processing applications until the new system went fully live.

The challenges of replacing the old underwriting administration system with the new one while implementing technology infrastructure upgrades included:

- Unwieldy legacy infrastructure, dated technology and systems

- Product and process complexity impeding transparency

- Limited IT time and skill in interfacing disparate systems and data

In issuing its Guaranteed Issue Whole Life policies, the company was constrained by the rigidity of too many of its internal processes and dated outsourced systems.

THE SOLUTION

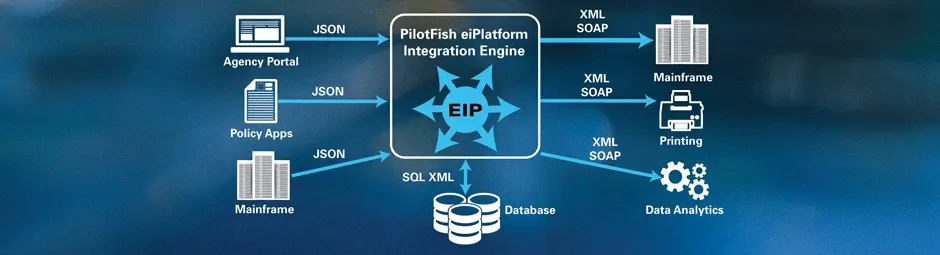

As the project progressed, the new system handled an ever greater number of underwriting tasks. PilotFish’s Integration Solution is the bridge between workflows and systems at every stage, operating as the data and systems integrator. PilotFish interfaces and expedited data transformations were critical to the continuation of core business processes while expected and unexpected disruptions occurred in live testing of the new system.

PilotFish senior engineers worked with the Guaranteed Issue Whole Life team of subject matter experts and internal IT staff, as well as representatives of the two vendors. A PilotFish Lead Software Engineer was embedded at the client site at key junctures to drive strategy and negotiate any critical path roadblocks.

PilotFish delivers a complete solution of integrated components that includes a graphical automated interface assembly line process and visual drag & drop data mapping. Easy reuse of components and interfaces is a distinctive PilotFish advantage, saving time and money throughout. The XML Data Mapping component generates XSLT transformations that transform any data format to any other data format. PilotFish transforms any standard industry format and interpretations of the standard, proprietary formats, or a company’s common model – anything to anything.

The PilotFish Interface Engine platform coordinated and integrated all downstream workflows. Before the switchover, PilotFish directed incoming policy application information to either the new or old underwriting system. PilotFish’s Interface Engine throttled the number of applications going to the new system and the numbers to the old system.

Every metric of the new system was verified during the real-life performance. Once the client was satisfied, the switch was flipped. Today, all incoming application data goes through PilotFish to be validated, parsed and transformed before moving into the new underwriting system.

Downstream, PilotFish coordinated the outbound data interfacing to the updated processes required for document printing, payment processing and beneficiary payments.

PilotFish’s Interface Engine delivered impressive built-in capabilities for incoming data translation, outgoing transaction construction, acknowledgment generation, process orchestration and scheduling.

PilotFish was the glue in the Guaranteed Issue Whole Life project implementing technology systems upgrades and improvements. PilotFish agilely dealt with legacy systems, proprietary systems, third-party solutions and new technologies.

THE BENEFITS

With PilotFish, any integration (no matter how complex) is handled with the same methodology and tools each and every time. PilotFish adheres to the architectural principles that our integration solution be easily extended using open source components and is infinitely flexible.

The insurer partnered with PilotFish over competitors as our solution is Java-based and supports a wide range of integration endpoints, processors and transforms. The company knew that PilotFish was a comprehensive lifecycle integration solution. They were confident that with our broad capabilities and experience, we would easily be able to meet anything that they threw at us. That’s why PilotFish senior engineers are deployed across a wide range of the insurer’s priority projects.

PilotFish is the integration innovator and leader on an increasing number of larger initiatives with specific deliverables important to core modernization across the business. The client meets its current and new integration requirements enterprise-wide with one easy-to-learn and use tool for non-developers and programmers alike. The PilotFish solution, built-in tools and elegant architecture are adopted by developers as well. And with PilotFish’s ingenuity, expertise and experience – the IT organization created a modernization program built on rapid test-and-learn cycles.

Since its inception, PilotFish has been focused solely on integration. We work with clients in ways that make sense for them and their integration challenges.

At the strategic level, the client has partnered with PilotFish to enable the multi-year transition of all its lifelines of business to a more modern technology platform that allows greater digitization, automation, flexibility and operational efficiency.

Since its founding in 2001, PilotFish has been solely focused on the development of software products that enable the integration of systems, applications, equipment and devices. Billions of bits of data transverse through PilotFish software connecting virtually every kind of entity in healthcare, 90% of the top insurers, financial service companies, a wide range of manufacturers, as well as governments and their agencies. PilotFish distributes Product Licenses and delivers services directly to end users, solution providers and Value-Added Resellers across multiple industries to address a broad spectrum of integration requirements.

PilotFish will reduce your upfront investment, deliver more value and generate a higher ROI. Give us a call at 860 632 9900 or click the button.